Best Ways to improve the security of mobile banking apps will be described in this article. Since you’re always on the move if you’re anything like me. To efficiently manage your money, including checking your balance, making transfers, paying bills online, and more, use mobile banking. Only around two-thirds of bank customers who own mobile devices presently take advantage of mobile banking, though. Why hasn’t the adoption rate progressed to its full potential yet? The absence of consumer trust is one of the causes.

11 Ways To Improve The Security Of Mobile Banking Apps

In this article, you can know about 11 Ways To Improve The Security Of Mobile Banking Apps here are the details below;

People are reluctant to put all their trust in technology, especially older generations. The idea of having all of their banking data in the palm of their hands, on a mobile app, concerns them more than it intrigues them.But how can you persuade the remaining portion of bank clients to benefit from the convenience of mobile banking when fraud, intellectual property theft, and malware are so pervasive in our technologically advanced world?

What Makes Banking Apps Dangerous?

The architecture of mobile banking apps is typically prone to several severe mobile banking flaws that could result in data breaches related to financial security.

An application programming interface (API) is used to connect a mobile-based online banking app to the bank’s backend system (APIs).

These APIs typically have open source code as their foundation, which is very helpful to app developers. But occasionally, these APIs might leave mobile banking applications with weak security gaps.

The irony in this situation is that source code protection or web app firewalls might not be able to close or fix these security gaps.

Attackers of online and mobile banking systems can benefit from machine-to-machine communication by building their own shadow APIs. Ironically, these hijacked endpoints do not reappear as shadow APIs.

Here are a few high-risk flaws that could harm the functionality of your mobile banking app:

Lack of a united app ownership

When it comes to securing mobile banking systems, app ownership emerges as one of the most perilous vulnerabilities. In this situation, there are typically two owners: one is the external owner and the other is an employee of the bank.

The line of business managers are in charge of mobile banking apps in the banking industry. The bank’s IT division is another proprietor of the app. In addition, a third party is in charge of managing the mobile banking app’s APIs and developing the app itself.

Due to the fact that the three owners described above share responsibilities, this style of ownership raises significant security issues. As a result, there is a good possibility that something could go wrong at any time.

Insecure data storage

The official app stores for iOS & Android provide a special level of security through a variety of mechanisms, like permission systems or TouchID. If you don’t use them effectively, you can run into online privacy issues, exposing your sensitive personal information to hackers. Also check How To Fix Game Crash Errors on Gaming PC

Faulty communication

Mobile apps must exchange data with servers, NFC, Bluetooth, servers, various authorization procedures, and authentication tokens, among other external data sources.

You can’t prevent this communication since otherwise the software wouldn’t work as well as it could. However, by exposing your data, this action might undoubtedly pose a threat to your mobile security.

Here are the several security flaws that banking, financial, and credit union institutions have to deal with. Let’s move on to a few significant incidents of banking fraud.

Critical moile banking fraud cases

Fake bank

The most recent app-based banking Trojans, Malware, phoney banking apps, phishing attacks, and brute force assaults that affect mobile banking apps are continually being found and stopped by mobile banking security researchers.

One such spyware called FakeBank keeps track of the client verification letters that banks send out. The spyware duplicates the verification code that mobile banking app users receive and delivers it to hackers or other cybercriminals.

Duplicate Flash Player

Duplicate Flash Player is a video application that can either be downloaded from a malicious download link in an unsolicited email or an infected SMS. Once an app has been installed on a smartphone, a permission popup appears asking the user for administrator access.

After that, the app’s malware develops a fake login screen that appears when the user opens it the following time. When a user inputs their login information for a bank or other website, the malware takes that information and transmits it to a database of bad people so that it can later utilise it.

Svpeng

Senior malware expert Roman Unuchek of Kaspersky Lab has discovered a fresh variation of the mobile banking trojan Svpeng. One of the most harmful mobile banking malware is this one.

In order to transmit and receive SMS, conduct financial transactions, make calls, and read contacts, for instance, the Trojan can draw itself over other apps and unofficial sources. It can even grant itself device administrator rights and thwart any attempts to reverse this activity.

What security measures can financial institutions take for apps?

Top 11 Ways to improve the security of mobile banking apps

Top 11 Ways to improve the security of mobile banking apps are explained here.

1. Add a multi-factor authentication feature

A protection system that only needs one password to be provided before allowing access to a customer’s bank account can be overpowered.

You can add an additional layer of security that is difficult to breach by implementing multi-factor authentication or two-factor authentication features, such as randomly generated one-time passwords or biometric authentication techniques like fingerprints.

2. Encourage the use of NFC-embedded SIM cards

While you cannot compel your customers to use this security feature, you can strongly advise them to do so. A Near Field Communication (NFC)-embedded SIM card is a SIM card that enables customers to safely download their credit card information into the NFC SIM card. Also check Jarvee alternatives

By not carrying their actual card and not swiping it, they reduce the likelihood that their credit card information could be compromised, potentially granting access to their mobile bank application. This mobile banking security tip is more of a way to protect the information of their financial accounts.

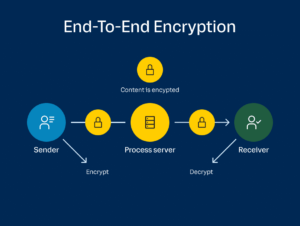

3. End-to-end encryption

Online transactions involve a variety of organisations, including issuing banks, retailers, card brands, and payment card companies. In a single year, tonnes of private information worth billions of dollars are exchanged. This has made it a popular location for hackers.

End-to-end encryption ensures that data is secure, providing a defence against this enormous threat. It does security audits and penetration tests, going above and beyond the standard security precautions.

4. Fingerprinting device

Fingerprinting technology has added a new layer to banking mobile apps. It gathers several different sets of information, including IP address, location, remote server, time of day, device type, location, PIN code, public wi-fi information, screen grab, mobile-enabled internet browser, etc.

To create an application with a fingerprinting function or one that is compatible with specific fingerprinting cell phones or devices, you can engage mobile application development teams or expert mobile app developers.

5. Offer real-time text and email alerts

Anyone using mobile banking on a mobile browser is probably also directly connected to their email and/or text messages.

They could easily stop fraud, social engineering, or an identity theft issue by sending a quick, real-time email or text alert to a customer informing them of account activity.

For instance, you can receive notifications on your mobile devices from various mobile bank applications if more money than the customer-specified threshold is spent.

Since they would probably be aware of such a sizable sum of money being taken from their account, this kind of security feature may immediately warn someone if the sensitive user information has been compromised.

6. The power of paperless banking

The introduction of IT technology and mobile apps has significantly impacted every industry. The majority of its procedures have been revolutionised by digitalization, and banking services and the financial sector are no exception.

With digitalization, banks are able to fully eliminate paper from the majority of their processes, including those as simple as creating a bank account, activating accounts, providing precise account activation instructions, confirming money transfers, and managing online transactions.

Because all the files are in digital form and are easy to access, using digital or online platforms helps to increase efficiency and transparency. Banking institutions will need a mobile app solution supplier who can offer them an enterprise mobility solution in order to accomplish all of these.

7. Utilize behavior analysis

There is specialised software available that can track and examine users’ online account activity and banking login locations.

Your mobile banking app may identify various business logic issues, unusual activity, or unauthorised access thanks to this technology for further examination.

An email or text alert informing the customer of suspicious activity may be followed up by a call from the bank to further investigate the matter.

8. Safe digitalized documents

Safe Digitalized Documentation is another method for enhancing the security of mobile banking apps. In a number of industries, including e-commerce, contact centres, retail locations, etc., setting up an electronic signature might be beneficial.

By transferring a significant amount of documents onto mobile devices, this technique enables financial institutions to provide their mobile banking consumers a number of advantages. Most importantly, it lessens instances of fraud and raises security.

9. Use secure access

Information about client accounts can be better safeguarded between the mobile web browser and the website they are connected to by using a secure internet connection and good technologies like HTTPS.

Customers will be better protected by this technology from data theft and phoney login attempts.

The majority of clients desire an acceptable level of convenience for mobile banking transactions, which puts financial institutions in a difficult position.

However, there is a higher danger of mobile security flaws with mobile banking for both the bank and the consumers of the banking.

The difficulty is in avoiding cybercriminals and working constantly to increase the security of mobile banking applications and make mobile banking secure.

Financial institutions may keep raising the risk score and security of their mobile apps while thwarting intruders like hackers by implementing new technologies and agile development procedures.

Furthermore, these technologies will offer reliable authentication for wireless banking carriers and mobile banking solutions. Also check Nitro PDF MAC

But this is a two-way street as well. Customers must also take preventative measures to increase the security of mobile banking applications.

Financial institutions that provide mobile banking applications should keep educating and motivating their consumers about Internet security and other issues that can place them at an elevated risk of fraud.

10. PSD2 regulations

PSD2 legislation’ main goal is to tackle banking security weaknesses including reverse engineering and money theft. Additionally, PSD2 regulations offer a powerful defence against fraudulent operations, intend to boost the use of digital documents, and promote digital security.

Additionally, it is in favour of open banking mobile technology as well as enhanced online security.

PSD2 enables close coordination between financial firms, FinTech companies, banks, large corporations, and clients. In addition, the regulation is focused on giving consumers significantly better online security in terms of online payments and overall customer experience.

11. Educte your customer

Controlling the financial security does not result in the completion of your work. You must also educate your clients about financial fraud. Clients should also be required to take protection against financial fraud in addition to this.

In addition, there are several serious authorization problems or business logic weaknesses that can harm customers’ experiences with mobile banking. Additionally, any banking transaction performed using a public wi-fi hotspot is risky.

Because of this, banks and other financial organisations that offer mobile applications must inform mobile customers about financial security. In order to avoid fraud and help clients secure their finances, banks must educate their customers on the newest mobile technology.

Conclusion

There is no denying that online platforms and mobile apps have made banking procedures more convenient for users. However, there is also a greater chance that hackers may compromise the data, creating a massive state of chaos. Therefore, the secret is to carefully put these online security measures into place.

You may greatly benefit from the methods for mobile application security that we have discussed in this article if you want to overcome all the drawbacks of traditional approaches and make banking mobile apps safer.

Therefore, the next step you must take is to get in touch with experienced mobile application developers and ask them how much it would cost to design an app that has all the characteristics mentioned above.