Comprehensive reviews Of Payplug will be described in this post. PayPlug, a service that is accessible to ecommerce company owners in the US and Europe, is one such alternative that we’re exploring today.

Guide & Reviews Of Payplug In 2023

In this article, you can know about Guide & Reviews Of Payplug In 2023 here are the details below;

PayPlug is used by who?

- PayPlug’s Pros and Cons

- PayPlug Prices and its Plan Features

- Plugins for e-commerce

- Assistance & Client Support

- What We Consider (our final verdict)

- There’s a lot to discuss, so let’s get started!

What Is PayPlug, According to a Review?

PayPlug is a safe payment option geared toward SMEs as well as traditional brick-and-mortar retail owners.

It’s quite simple to use; all you have to do is register for the PayPlug extension in order to begin receiving payments both online and offline.

Simple, yes? It was created in 2012 by technologists Camille Tyan and Antoine Grimaud who aimed to create technology that would simplify internet commerce.

Since 2017, Natixis Payments has held the majority of the company’s shares.

Natixis is a corporation that offers what PayPlug identifies as, thus this is significant.

Solutions that are user-centric and specifically suited for retail, corporates, SMEs, public bodies, associations, financial institutions, fintechs, and individuals across all of Europe.

In other words, PayPlug might be the platform you’ve been looking for if you’re a business that needs to accept payments.

Who Uses PayPlug? A PayPlug Review

According to the PayPlug website, retailers appear to be the company’s key clients.

PayPlug was founded in France, and some (but not all) of the companies mentioned as its clients on its website are enterprises with French ownership.

Online clothing stores, a supplier of beekeeping supplies, and a supermarket and olive oil store were all discovered.

So it’s reasonable to state that this solution is used in a wide variety of markets!

What Products Does PayPlug Offer? – A Review of PayPlug

PayPlug offers two categories of products:

- Online transactions

- Online payments

1. Online Payments

Since COVID-19, an increasing number of companies have moved their operations online. If this describes you, have no worry.

PayPlug classifies its online capabilities under three groups:

- Customization

- Security

- Performance

Customization

When using PayPlug, online businesses can alter their payment sites to better reflect their brand.

Additionally, you can set up one-click payments to make it even easier for clients to pay.

Customers can use this function to save their payment card information so they can purchase with only one click the next time (kind of like Amazon!).

To allow clients to pay you using a single link to a secure payment website, you may also make payment requests by email and SMS. Also check Onboarding Software

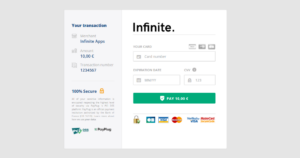

In addition, you may experiment with integrating your payment page in three different ways: through an integrated page, a redirected page, or an integrated payment form.

The approach with the highest conversion rate can then be chosen.

Last but not least, you may give clients a variety of payment options. You can even let them pay in 2, 3, or 4 instalments or offer deferred payment options.

When combined, all these features enable you to meet a range of particular requirements and offer consumers a more individualised payment experience.

Security

An extremely safe tool is PayPlug. In fact, it claims that its 3D-secure feature can boost checkout conversions by 8% while reducing fraud by up to 50%.

How? The PDS2 compliant 3D-Security feature of PayPlug employs a method that prevents fraud and is PDS2 compliant (an EU requirement as of 2019).

Specifically, by identifying dubious transactions and halting them immediately.

When a customer is ready to purchase something, they are either redirected to a secure payment page via a pop-up or a redirect, where they are prompted to input their payment details.

The customer’s payment information is not disclosed to the online retailer. Your customer is then directed back to your store after the transaction is finished. No private card information is kept on your server. The PayPlug status and security reports, which are fortunately simple to find, were examined. The status of their portal, bank transfers, payment requests, and payment API can all be easily seen.

All were perfectly functional at the time of writing, and when we reviewed the metrics for July 2020, we could see that there had been no problems.

A past incident history for the most recent quarter is also accessible.

Although there had been some 3D-Secure problems, they were all fixed on the same day.

Performance

A straightforward interface allows PayPlug users to monitor their transactions.

Your orders and sales are displayed here in real-time.

You may access your order and transaction history from this same page and export it in an accounting format.

Your payment history can be filtered to show failed or cancelled transactions thanks to PayPlug’s performance tracking features.

This will make it clear to you if a consumer has insufficient funds or that their information was entered wrongly.

Finally, you may design payment buttons that make it simple for clients to make purchases from you.

Before checking out, they don’t have to navigate through numerous payment pages.

These can be used on your Facebook page as well as other online locations where clients engage with your business.

They simply need to click the “buy” button and enter their information on a secure payment page, and they’ll have bought something in a matter of seconds!

2. In-Store Payments

For proprietors of brick-and-mortar stores in France, PayPlug provides physical payment terminals.

The majority of cash registers on the market are compatible with the payment terminals.

These terminals are designed similarly to the online features in that you can handle all of your transactions conveniently from a single dashboard in real-time. Also check check link site

Setting up an online PayPlug account, registering, and ordering their terminal are all that store owners need to get started. When the terminal arrives, they are prepared to depart.

A PayPlug Review: Pros and Cons

On trustworthy review websites like TrustPilot, PayPlug seems to perform well overall.

But a good old-fashioned pro-con list still reigns supreme, so we’ve provided one for you below.

The Pros

You don’t need any technical knowledge to take advantage of this solution to the fullest extent because the dashboard is so user-friendly.

- PayPlug can be used by your consumers without them having an account.

- English, French, Spanish, and Italian translations are offered.

- The ACPR has approved PayPlug as a payment institution (Bank of France)

- It is quick and safe.

- PayPlug takes all Visa and Mastercards, debit, credit, and CB, so you can offer clients a range of payment options (Carte Bleue).

- There are no setup costs.

- It works with a number of widely used plugins.

The Cons

- On their website, PayPlug doesn’t provide a lot of information regarding their features.

- There is no mention of allowing users to make purchases on Instagram.

- Finding information on VAT fees for businesses not based in France requires some searching.

- On their website, there are no prices for in-store payment methods.

A PayPlug Review: Pricing

- We are unable to describe in-store pricing because it is not displayed on the PayPlug website.

- There are three online payment plans, and you can see what each one costs and offers below:

- The starter plan is ideal for start-ups and small businesses.

- This works better for established companies with a bigger turnover.

Premium Plan: This is intended for current businesses who desire further assistance and support.

The Starter Plan Costs:

- On Eurocard transactions, 1.6% plus 0.25 Euro

- On business cards, 1.9% plus 0.25 euros each transaction

- On transactions using international cards, 2.5% plus 0.25 euros…

The Pro Plan Cots:

- On Euro cards, the Pro Plan costs 0.8% plus 0.15 euros every transaction.

- For transactions with business cards, 1.9% plus 0.15 euros

- On transactions using international cards, 2.5% plus 0.15 euros…

- & + 30 euros each month

Cost of the Premium Plan:

- On transactions with Euro cards, 5% plus 0.15 €

- A business card transaction costs 1.9% plus 0.15 euros.

- On transactions with international cards, 2.5% plus 0.15 Euro

- + 80 € / month

- Back to top

What you get in return is as follows:

Four groups of features make up PayPlug:

- Plugins and integrations

- Paid pages

- Generating reports

- Customer service

You get access to the following integrations and plugins with each of the three plans:

- Shopify plugins (more about these below)

- Libraries and REST API

- You accept payments made with CB, VISA, and Mastercard.

- Integration of SMS and email

- Integrations with payment buttons

One-click payments are only available with the Pro and Premium subscriptions, and only the Premium plan gives your clients access to installation and delayed payment options.

The following payment page features are available on all three plans:

- Payment pages that are hosted or integrated

- Responsive payment websites for mobile

- Your logo can be added to the payment pages.

- Having access to a programmable interface

- Access to the 3D-secure function of PayPlug

Smart 3-D Secure is only available with the Pro and Premium plans, and only the Premium Plan gives you access to integrated payment sites with AJAX forms.

Each of the three programmes offers the following reporting instruments:

- Real-time transaction tracking

- Exporting transactions to CSV and XLS files

- You can monitor declined payments.

- The multi-user account option is only available with the Premium plan.

- Access to the PayPlug online help centre and email support is included with all three levels.

However, you’ll have access to telephone help if you’re a Pro or Premium customer.

Only Premium users have access to quarterly reporting, albeit it’s not obvious what those reports actually contain on the PayPlug website.

What About ProPlug’s Ecommerce Plugins?

Numerous e-commerce plugins, including some of the most popular ones like WooCommerce, Shopify, Magento, PrestaShop, and OpenCart, are compatible with you.

It’s also important to note that you can choose to sign up for updates, so you’ll be the first to know when PayPlug adds new plugins.

A PayPlug Review: Help and Support

There is a distinct part on the PayPlug website for customer service.

For clients who require further information on specific subjects, such as making a payment, getting a refund, submitting a payment request, or setting up your store in a different language, this comprises a number of instructions.

Users can type their inquiries into the online Help Center as well.

Users can find answers to their questions in the FAQ section, which covers subjects like setting up PayPlug and updating account and bank information.

There are six sections in the Help Center:

- Setup

- Subscriptions

- Transfers and banks

- General

- Payments

Security

For non-PayPlug users who have paid with a PayPlug merchant and have run into trouble, there is also a separate section.

Refunds, payment refusals, and how to file a claim against a retailer are some of the common topics covered here.

What We Think

Overall, we believe PayPlug to be a solid alternative payment method that works with some of the most well-liked e-commerce platforms utilised by small businesses and entrepreneurs.

Reviewers appear to like it and find it simple to instal and use, and its capabilities appear to be quite extensive, based on a brief search of the internet.

Although its pricing sounds affordable, using it in the US will cost you more each transaction than using it in the EU.

The PayPlug website is simple to use and accepts all major credit cards.

Overall, we believe PayPlug is a fantastic alternative for you if you are a startup or an established ecommerce company owner searching for your first online payment solution.