Starting a new business, albeit small, can be a bit stressful. There are several factors to consider to ensure that whatever you plan to get into can be a success. But even while you stew about it, small businesses are certainly worth the effort you put into them. For one thing, you have the flexibility that more prominent companies don’t, making necessary changes when the need arises. You can also be in complete control, not worrying about consulting with the higher-ups when decisions have to be made or exciting ideas are considered. You are also recognized by your clients as an expert in your field and get the gratification for your accomplishments. That should give you motivation enough to focus on a small business that belongs solely to you.

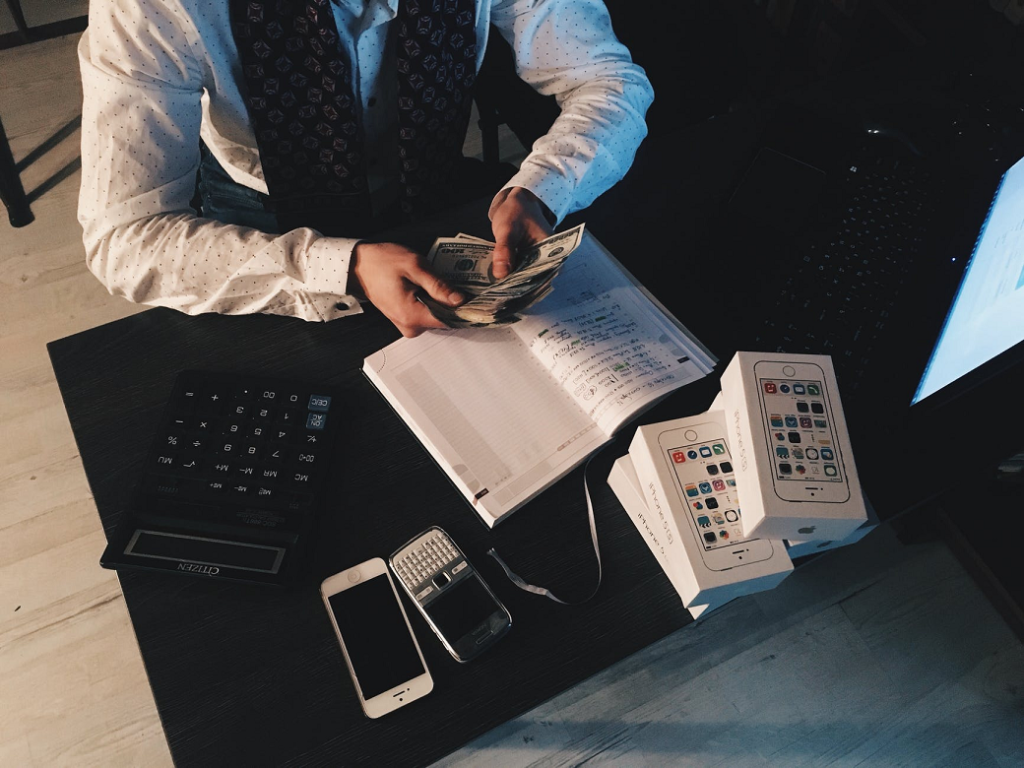

While a business may be small, it still needs capital to get started. There are expenses to be expected, and you need to be prepared for them as they come. One of the more significant challenges you may encounter is acquiring funding for your business. This is unless, of course, you already have a sizeable amount ready for you to get on your way. If not, it is good to know that you can get funding elsewhere and get your business going. For instance, you can avail of funding for online stores and turn your online business dream into a reality. Here are other methods to employ to acquire funding for your small business.

Angel investors

Angel investors are people who invest their personal funds and are typically wealthy businessmen who provide funding for startup businesses. More often, they do this because of a business’s potential to have a higher return on investment. There are several advantages of getting funding from angel investors. Approval is much quicker because you deal with them directly, and they do not need to consult with stockholders or board members. Once you are approved, you also know that you are in the right business because they are willing to invest in you. These people have experience and know when a business venture is feasible or not. They are also ready to help make your business succeed since they are invested in it. You can also expect more cash provided for your business in a lump sum, which allows it to grow in a shorter amount of time, typically spread through time from other investors. However, you will need to share a percentage of your ownership to an angel investor in exchange for the funding.

Family members and friends

When it comes to starting a business and trying to succeed in it, the people who care about you are people you can seek help from. Each one may not have enough to cover all of the funds you need, but together, you may get whatever is required for your startup. There is a bit of danger, though, when it comes to money matters and personal relationships. Misunderstandings can happen, such as a business’s failure, causing a rift and affecting these relationships. If you get help from close friends or family members, it is best only to borrow enough to get the business started. Be responsible and maintain the trust you are given. Prepare terms that everyone will adhere to and get legal advice for everyone’s safety and peace of mind.

Bank loans

Bank loans are the most typical methods of funding among business people. There are stricter procedures, but you can avail of funds for small businesses such as yours. You need to keep in mind that you should have a business plan and a forecast of profitability. Should you decide on acquiring a bank loan, it would be to find a lender and deal with them personally. By doing this, you are assured that you get the paperwork done accordingly and gain insight into how your loan approval can be facilitated sooner.

Credit cards

If you own credit cards and have a good credit score, you can make use of them to fund your small business. Credit card companies do not ask for too many requirements. They are not concerned about how you run your business or what you need the money for. What they expect is that you have your balance and interest paid when they are due. It is also much easier to acquire the funds you need when you need them. If you can get your balance paid off within a month, you can avail of a business credit card that offers more credit limits than a personal credit card. The downside is that interest rates are higher, which could hurt your small business if you are not careful.

Crowdfunding

Crowdfunding is another method of acquiring funds for small businesses. Simply put, crowdfunding uses the collective effort of numerous individuals such as friends, family members, and interested investors to fund a business venture. It uses social media to reach out, along with crowdfunding websites, and raise the capital needed. Successful businesses that have used crowdfunding campaigns to fund their enterprise offer investors their products or give discounts for the items they buy as a sort of return of investment.

Personal funding

Realistically, starting a business, big or small, can be risky. This is the reason why a lot of lenders have second thoughts about investing money in it. If you feel that your business has a lot of potential for growth and success, you may want to fund it yourself from your savings. You could consider selling some of your assets, such as your home, if you are sure that you can accept whatever risks it entails. The obvious advantage here is that you are not in debt and are only accountable to yourself. How you run the business and make it prosper is entirely in your hands. And because it is your own money you have invested you will undoubtedly work harder to ensure that your business is safe.

Starting a small business takes hard work and commitment. It is also the first step towards venturing into something much bigger.