Weddings are so expensive that having to postpone or reschedule can be terrible, especially if it is due to unanticipated circumstances beyond your control. Weddings also involve specific liabilities that most personal insurance policies do not cover, such as liquor liability, potential damage to pricey venues, and expensive jewellery or apparel that could be lost or stolen. As a result, it’s always a smart idea to purchase wedding insurance to safeguard yourself on your big day.

A good wedding insurance policy will cover your expenses if you have to cancel or postpone your wedding. And, if everything goes as planned, coverage will protect you from liability if someone is injured at your wedding or if vendor property is damaged or stolen.

The best wedding insurance companies provide extensive coverage for low costs and make it simple to quote, buy, and review policy online. You’ll have piece of mind knowing you’re safe when you say “I do.”

What Are the Typical Wedding Insurance Costs?

Costs are usually structured as a single charge to give coverage on the wedding day. Premiums typically range from $70 to $200, with additional charges for other types of coverage.

Top 7 Best Wedding Insurance Companies In 2021 Are List Below:

1. Markel

Markel is the best wedding insurance company that may have rated first overall. Markel now provides event liability covers in addition to event cancellation coverage, and consumers may acquire a wedding insurance quote online.

Markel was formed in 1930 and is a Fortune 500 company. It has an A+ rating with the Better Business Bureau, and while the company has several documented complaints, none are related to its wedding insurance. Markel wedding insurance offers two important coverages: wedding liability insurance and wedding cancellation insurance.

The liability element of a Markel coverage covers up to $2 million in damages to a venue or bodily injuries sustained at your wedding. Liquor liability insurance for hosts can also be added. Up to one day before the wedding, coverage can be purchased.

Wedding cancellation insurance can be acquired 14 days or more before your big day. Markel’s event cancellation coverage reimburses your non-refundable deposits and other fees if you have to cancel or postpone your wedding due to unforeseen circumstances such as vendor bankruptcy, inclement weather, or military deployment. It also helps to safeguard wedding apparel, jewels, gifts, photographs, and other items.

Markel wedding insurance costs vary depending on coverage limits and options. However, as with The Event Helper, if your policy does not fulfil the requirements of your venue, Markel will reimburse the entire amount of your premium.

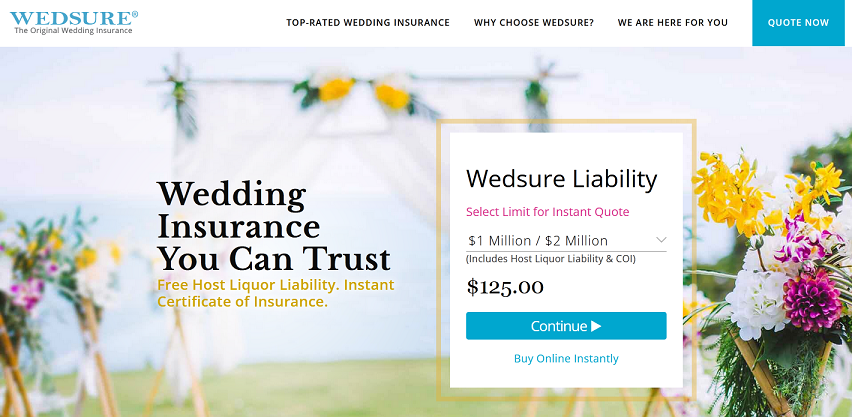

2. WedSure

WedSure is the best wedding insurance company offered by R.V. Nuccio & Associates, a nationwide broker with over 25 years of experience and licences in all 50 states. Allianz, one of the world’s leading insurance companies, backs the wedding policies.

Customers may use WedSure to get an estimate, buy a policy, and print proof of coverage online at any time of day or night.

WedSure wedding insurance starts at $125 for $1 million per occurrence and $2 million aggregate coverage. It covers not only the wedding and celebration, but also the wedding rehearsal and rehearsal dinner. Free host liquor liability coverage is also included in policies.

WedSure offers wedding cancellation/postponement coverage in addition to wedding liability insurance to help reimburse your out-of-pocket expenditures if you have to cancel or postpone your wedding.

3. Allstate

Allstate is a large national insurance company that offers wedding cancellation and liability insurance through Markel rather than in-house. Because most wedding insurance companies are specialty providers, Allstate is a viable alternative if you want to get wedding insurance in addition to other types of personal insurance.

If you want to buy Allstate wedding insurance, you must do so between 14 days and 24 months before the ceremony. You can acquire a quotation by going to the Markel and Allstate collaboration page using the link on Allstate’s page.

Cancellation insurance compensates you for missed deposits and other expenditures. It can also be used to safeguard wedding gifts, clothing (including wedding rings), and damaged photographs or films. However, like other carriers, this coverage does not refund expenses if the bride or groom just changes his or her mind.

Allstate’s event liability coverage covers you in the event that someone is injured or property damage occurs at the wedding. If you need to file a claim under your policy, you may be required to pay a deductible. Finally, honeymoons are not covered, but Allstate does offer a separate policy if you wish to protect your trip.

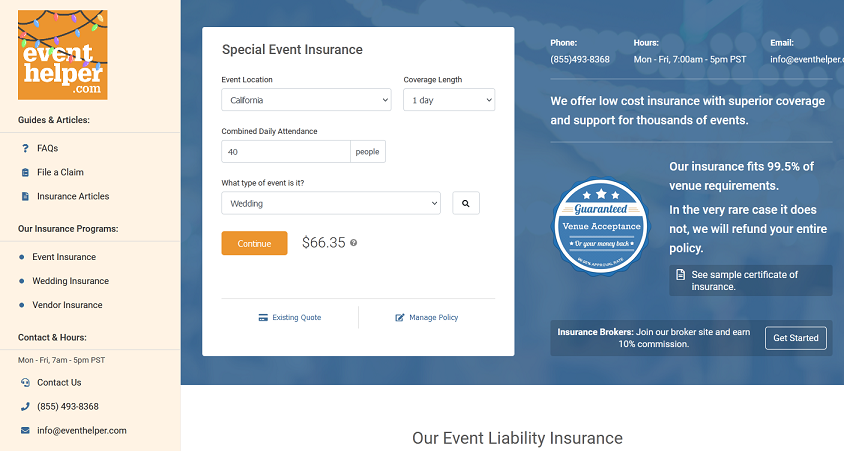

4. The Event Helper

For various reasons, we chose The Event Helper, which was created in 2009, as the best wedding insurance company. First, as of September 2021, the company has an A+ rating with the Better Business Bureau (BBB) and no registered complaints.

The company also offers the best starting price of any wedding insurance coverage we could locate, with plans starting as less than $65. Finally, the company ensures that its coverage will meet the needs of your venue; if it does not, they will return the whole amount of your policy.

The Event Helper wedding insurance provides general liability coverage of $1 million to $2 million per occurrence (and $2 million to $4 million aggregate) that protects against venue property damage and bodily injury to guests. And you’re covered no matter where your event takes place in the United States.

In addition to liability insurance, The Event Helper may provide hired-car insurance, retail liquor insurance, and coverage for individuals who need to cancel or postpone their wedding (for a reason other than a change of heart). In addition, all policies include free host liquor liability coverage.

With The Event Helper, you can submit a little information about your wedding and get a quotation, select coverage, evaluate a policy, and buy it online. You can then email or download insurance certificates to satisfy vendors.

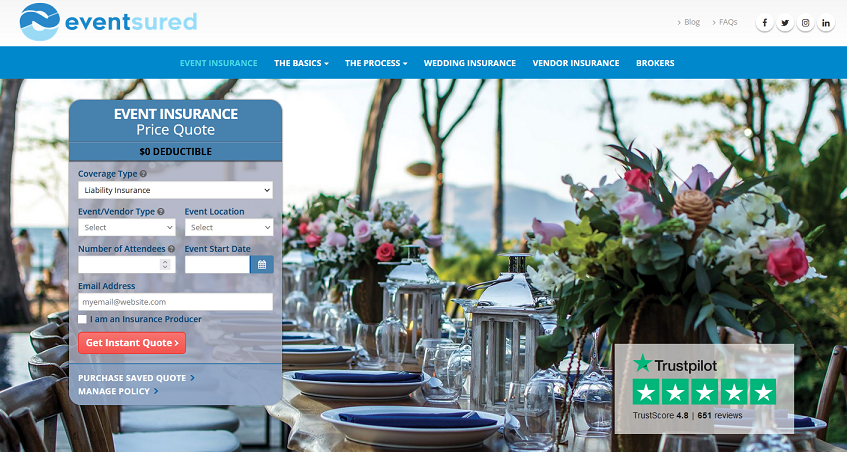

5. Eventsured

Eventsured, a subsidiary of Foresite Sports, was founded in 1998. As of September 2021, the company has an exceptional rating on Trustpilot (4.8/5 stars) and excellent online customer ratings.

Eventsured’s wedding insurance starts at $117 for $1 million in coverage per occurrence and $2 million in aggregate. Furthermore, Eventsured wedding policies have no deductible, so you won’t have to come up with any money of your own if you need to file a claim.

Eventsured insurance can be obtained online in minutes and covers general liability, personal injury, and liquor liability, as well as damage to a venue or vendor equipment. Eventsured insurance also includes no-fault coverage, which covers the cost of medical care for anyone hurt at your wedding. (This coverage has a $1,000 basic limit that can be upgraded to $5,000 or $10,000.)

While plans purchased through Eventsured are intended to cover only the day of your wedding, you can also add coverage for a rehearsal dinner, gifts, clothes, jewellery, photographs, or films.

Finally, Eventsured customers can add coverage for cancellations or postponements, as well as any lost deposits, if a vendor fails to show up or goes out of business.

6. USAA

USAA is a financial services company based in San Antonio, Texas. American servicemembers, reservists, veterans, and qualifying family men are eligible for membership in the company.

In addition to banking, investment, and insurance services, USAA provides wedding and other special event insurance to its members. Although this policy is covered by Markel, USAA members may be eligible for special benefits such as a 15% discount.

Best wedding insurance purchased by USAA members includes basic Markel coverages such as wedding liability and cancellation/postponement protection. The insurance protects you from lost deposits, cancellation costs, injuries, property damage, and other potential liabilities.

7. Travelers

Travelers’ Wedding Protector Plan is another option to consider if you’re traveling for your wedding. Travelers, which was founded in 1853, was the sixth-largest provider of both property/casualty and homeowners insurance in the United States in 2020.

Travelers wedding insurance covers items like misplaced rings, destroyed photos, and damage from extreme weather. Coverage can also be extended to include not only the United States and its territories, but also Mexico, Canada, and the United Kingdom. In the event of an unavoidable cancellation or postponement, policies also provide for payment.

In addition to its wide national presence, Travelers is a wonderful option for destination weddings since it provides 24/7/365 claims assistance; if something goes wrong, it doesn’t matter what time zone you’re in. Furthermore, there is no deductible if you need to file a claim. Travelers also provides travel insurance if you want to protect yourself against out-of-pocket expenses when you book your trip.

Travelers wedding insurance starts at $160 and can cover lost or damaged wedding apparel, calls to duty, damaged gifts, liquor liability, and additional fees if one of your vendors cancels at the last minute and you have to book a replacement.