Personal finance software can help you master the fundamentals, become more efficient with your money management, and even discover new ways to meet your long-term financial goals. Choosing the best personal finance software is determined by your current financial situation.

Some personal finance software can assist you in mastering budgeting and expense tracking, while others can assist you in managing your investment portfolio. Of course, your budget for personal finance software is important as well.

Our list of the best personal finance software includes both free and paid options to meet a wide range of financial objectives. So take a look and you’ll be able to get your finances in order in no time.

To find the best software for your needs, consider what you require the most personal finance is a broad term. Saving, budgeting, investing, taxes, and bill management are all possible applications.

1. Quicken

Quicken is one of the best personal finance software. It is the best app for managing your investments, taxes, and budgeting all in one place. You’ll be able to do everything from calculate your net worth to automatically pay your bills.

Quicken comes at a cost. There are four packages to choose from: starter ($34.99), deluxe ($49.99), premier ($74.99), and home & business ($99.99).

If you only want to track your finances, the starter pack will suffice; however, if you want to perform more sophisticated functions, it may be worth investing. Upgrade to deluxe for more customization, and premier for more assistance with investments, taxes, and saving.

2. YNAB

YNAB is an acronym that stands for “you need a budget,” and it is a best personal finance software that assists users in creating one. You will be guided through the process of allocating your money among different areas of your life and will be assisted in staying on track.

This is great for people who are struggling with debt or managing their finances, but if you already know the fundamentals of budgeting, it may be unnecessary.

The software costs $84 per year, but you can get a 34-day free trial first, and there is a money-back guarantee. YNAB claims that their software pays for itself in the first year, with users saving an average of $6,000 per year. In addition to the software, you’ll be able to attend fifteen workshops designed to help you better manage your money.

3. Pocketguard

Pocketguard is an app that helps you manage your finances and save money. It has an appealing interface and is extremely simple, making it ideal for those who want to track their finances without the extra frills found in other apps.

If you want to know more than just incomings and outgoings, you should consider upgrading to Pocketguard Plus.

The paid version includes more advanced features such as categorizing your spending habits (similar to YNAB), manually tracking money (that you may receive in cash), and categorizing your saving goals.

The annual subscription costs $34.99, but the first week is free.

4. Mint

Mint’s primary function is to consolidate all of your bank accounts and credit cards in one place and track your finances. You can also include loans and investments.

Mint is the unique best personal finance software in that it includes both a phone app and a website, allowing you to track your finances while on the go. You’ll be able to track your spending by category with graphs and charts, and you’ll get personalized recommendations.

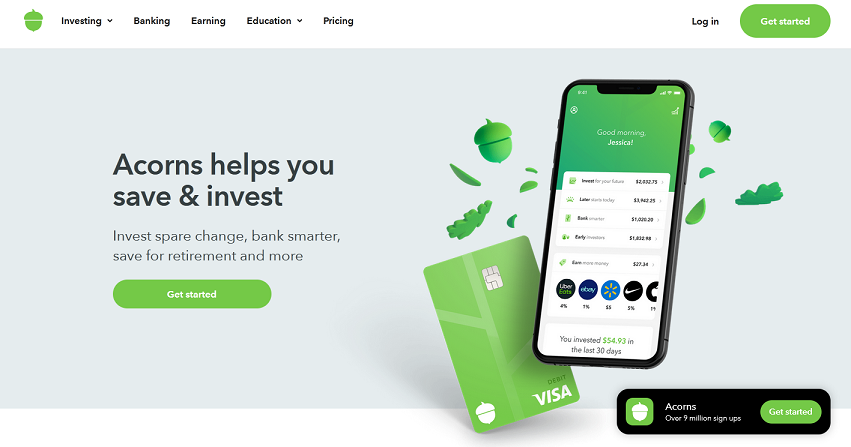

5. Acorns

If the thought of investing frightens you, Acorns could be a good place to start. Rather than setting aside a large sum of money, you can let Acorns invest your spare change. You may discover that the loose cents add up to more than you expected!

You will be given an Acorns card that will automate the investment of your loose change. You can also get tips and money management advice directly from the app to help you improve your investment strategies over time.

It’s ideal for those looking to save for retirement, as there’s a dedicated service called Acorns Later that will match you up with an appropriate IRA account.

6. Albert

Albert is the best personal finance software that functions as a personal money advisor. In addition to tracking your spending, the Albert Savings feature allows you to receive personalized budgeting recommendations and use a custom portfolio for guided investing. All of this is provided for free.

There’s also a feature called Albert Genius, which provides you with one-on-one advice from an advisor on how to improve your financial management.

This comes at a cost – but the amount you pay above the minimum contribution of $4 per month is entirely up to you.

7. Robinhood

If you’re ready to move beyond auto-savings apps like Acorns but aren’t quite ready to become a full-fledged trader, Robinhood is a great best personal finance software option.

It is one of the best online brokers for both experienced and new investors due to its real-time quotes, customizable watchlist, and research tools. They’ve also recently introduced fractional shares, which allow you to invest in any company even if you can’t afford a full share.

Furthermore, their app is simple to use, allowing advanced trading without feeling overwhelmed.

8. Stash

Stash Invest is another excellent choice for new or aspiring traders. It’s a one-stop shop for everything money-related, and it’s designed to help you learn as you go; thanks to the dedicated app, this has never been easier. Depending on your needs, you can select a banking, investment, retirement, or custodial account.

Unfortunately, you’ll have to pay a monthly fee of $1-9 to use Stash; the more you pay, the more features you’ll have access to. It can be a good place to start because of the educational content, but it may not be worth your time after you’ve learned the basics.

9. TradeStation

TradeStation is the best personal finance software suited for more active and experienced traders who do not need to learn the fundamentals. The technology provided by TradeStation, which is designed for professional traders, is a major draw.

Advanced order management, automated strategy trading, and customizable charts are among the features.

You can fund various accounts, including an IRA, with either futures or equities. One significant disadvantage is that, unlike other platforms, ETFs and mutual funds do not have no commissions.

10. TD Ameritrade

TD Ameritrade is another stock trading platform that provides commission-free trading on stocks, options, and ETFs. The commission for other trades, on the other hand, is higher than average.

The platform includes a variety of resources for self-education in trading, such as a curriculum and streaming news.

You can open an account for a variety of reasons, including retirement and education savings. If you’re not sure what you want, you can open a standard account for more options.

11. E*Trade

E*Trade is the best personal finance software and the most popular trading platforms, thanks in part to its advantages for both experienced traders and newcomers. Stocks, options, and ETF trades all have no commissions, making them ideal for those who trade frequently and want to save money.

However, for those who are less confident, there are numerous resources available to provide the necessary grounding. You can even forego investing entirely and let E*Trade handle it for you through automated trading.

You can create the account that best meets your needs, whether it’s for retirement investing or running a small business account. All accounts are designed to trade stocks rather than provide advice or education.

12. Turbotax

If you’re nervous about filing your taxes and want to be guided through each step, Turbotax is a great tool to have on hand. All you have to do is enter your information and follow the instructions; if you use Turbotax year after year, this will become easier as the software remembers your information.

The service is free if you use a form 1040 with no attached schedules, but you must pay if you have a more complicated process. There are services specifically designed for self-employed individuals and small business owners, among others. You can also seek advice from a CPA or an Enrolled Agent.

Turbotax is a more expensive option than others, with the complete self-employed package costing $119.99. However, it is comprehensive, including industry-specific tax deductions. You should keep in mind that the cheapest tax software may not be the best for your needs, so make sure you know what package will benefit you the most!

13. H&R Block

H&R Block provides a more upfront and helpful way to prepare for tax season than traditional services. They provide a comprehensive and robust support system that allows you to easily ask any questions you may have along the way.

The base price for their services is $59, with additional fees added depending on your circumstances, such as living in multiple states or having a complicated income.

14. Truebill

Truebill is a best personal finance software that assists users in lowering their bill costs and locating the best deal. They accomplish this by negotiating your rate for you – you upload the details of your bills, and the team will look for better deals or negotiate on your behalf. All you have to do now is wait for the results.

Truebill does not provide a free service, but rather than paying a monthly fee, you will split the profits of your savings: Truebill takes 40% of the total amount. That may appear to be a steep price, but considering you’d be paying the full price for your bills without the app, it’s actually quite reasonable.

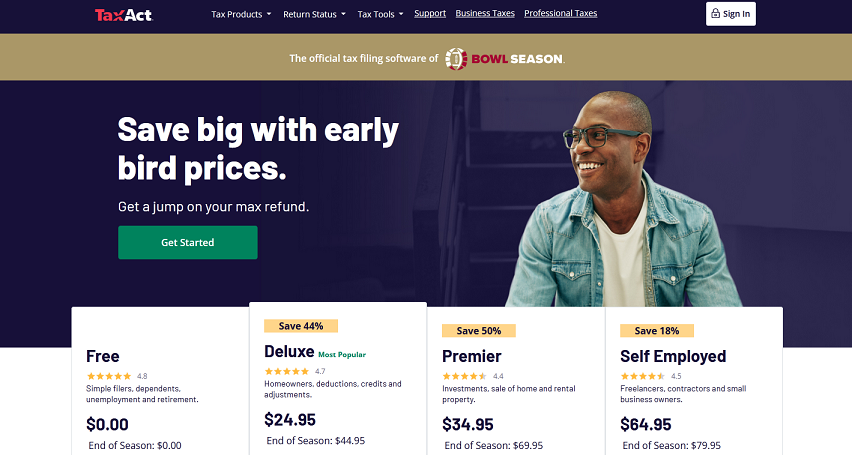

15. TaxAct

TaxAct may be ideal if you need a quick and easy-to-use software – simple returns can be completed in ten minutes, and complex returns even faster.

It is the best personal finance software excellent choice for those who do not want to pay more than necessary to file their taxes. If your annual gross income is less than $66,000, you may be eligible to use their free version.

Even the Premier+ option (for those with rental properties and investments) is only $57.95, which is less than the basic H&R Block software.